💥 Your Credit Score Is CostingYou More Than You Think

Got screwed by credit cards?

Stolen identity?

Bad financial advice?

Premature investments?

We can help.

🔥 Real Clients. Real Comebacks.

Don’t let credit issues hold you back any longer. We’re here to pave your path to a brighter financial future.

We've helped thousands just like you! Here's how we do it

“Credit Pro Max completely turned my life around. I went from constant denials to finally getting approved for a new car at a fair rate. The Credit Comeback™ Course gave me the knowledge, and the DFY Service did the heavy lifting.”

“I was drowning in collections and charge-offs. Within a few months, Credit Pro Max cleaned up my report and I finally closed on my first home. Best investment I ever made.”

“The accountability and support are unmatched. They fought for every deletion like it was their own credit file. My score jumped over 120 points, and now I qualify for funding to grow my business.”

“At first I thought it was just another credit repair company—but they proved me wrong fast. With the Credit Comeback™ System, I’m back in control of my financial future.”

“I never thought I’d see the day my credit was back in the 700s. Credit Pro Max made it simple, fast, and stress-free. The Comeback Course showed me exactly how to protect what I built.”

“From repos and late payments to approvals and funding—Credit Pro Max delivered exactly what they promised. If you’re serious about a fresh start, this is the team you want.”

The Future of Credit Approval Restoration is Here

1 - 2 - 3 Unparalleled Credit Transformation with Credit Pro Max

Here’s What Happens When You Stop Playing Small

1. Personalized Credit Repair Strategies

Based on your unique situation, we develop a personalized credit comeback blueprint. This may include disputing inaccuracies, negotiating with creditors, or advising on debt management strategies to improve your credit score.

2. Comprehensive Credit Analysis

We start with a detailed review of your credit report from all three credit bureaus. This allows us to identify any discrepancies, outdated information, or areas that need immediate attention.

3. Continuous Monitoring and Support

Our services extend beyond initial repairs. We offer continuous monitoring and regular updates on your credit status, giving you peace of mind and helping you stay on track with your financial goals.

4. Education and Resources

We believe in empowering our clients. You’ll have access to educational resources about credit management, financial health, and strategies to avoid future credit pitfalls.

Dispute Any Account

With all 5 credit bureaus, yes we said 5

* bankruptcies are additional cost and take 60 days for removal

** lates are additional cost and take 60 days for removal

*** open accounts are additional cost

So if you’re not ready to change that, don’t waste our time.

But if you’re sick of the BS…

👇

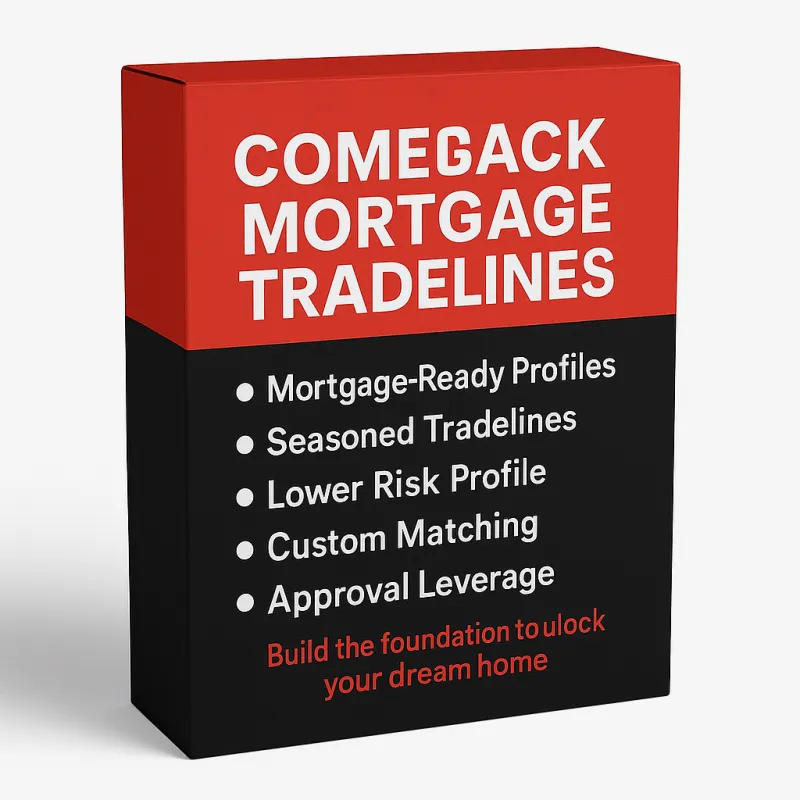

INTRODUCING

The Perfect Credit Comeback™

Credit Comeback™ Course

The #1 Step-by-Step System for Rebuilding, Protecting, and Leveraging Your Credit into Lasting Financial Freedom.

100% risk free

Here's what you get:

Clear Path to Results – No guessing, no wandering. We’ll map out exactly what’s next, so you know where we’re headed and how fast we can get there.

Your Personal Credit Comeback Plan – Custom-built for your situation, designed to fast-track approvals, leverage, and opportunities.

Accountability + Support – We’re in your corner, pushing, tracking, and fighting for every single deletion, removal, and score boost you deserve.

Great bonuses

Total value: $297

Today Just $97

"Best purchase ever!"

“I honestly never thought I’d break back into the 700s—but Credit Pro Max made it happen. The process was fast, simple, and stress-free. The Credit Comeback™ Course gave me the exact steps to protect and grow what I’ve rebuilt.”

TRY IT RISK FREE

100% Money Back Guarantee

We’re so confident in the Credit Comeback™ System that we back it with our Godfather Guarantee:

👉 If you don’t see real score improvements within 30–45 days, we’ll give you your money back. No hassle. No excuses.

You get results — or you pay nothing. That’s our promise.

Credit Pro Max™ — An offer you can’t refuse.

STILL NOT SURE?

Frequently Asked Questions

aka Excuses We Hear Daily

Question 1: Do I need to mail letters?

Yes. But can do it all for you. All you need to do is print and mail it.

Question 2: Can I do this myself?

Sure. If you love rejection and slow results.

Question 3: What if I live in another state?

We’re nationwide. Doesn’t matter where you are.

Question 4:How long does this take?

30-45 days for most items. Some results even faster.

💥 “Your Credit Score Is a Loaded Gun — Aim It at the Banks, Not Yourself”

Stop bleeding cash on denials, high interest, and embarrassment. Discover the hacks, shortcuts, and strategies the wealthy use to flip credit into cars, homes, and business funding.

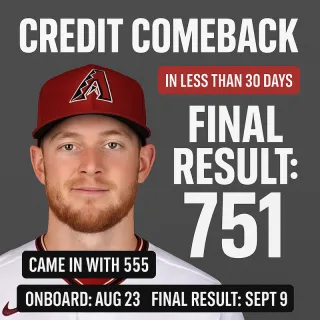

From 555 to 751 in 17 Days — A Real Credit Comeback™

Real client jumped from 555 to 751 between Aug 23 and Sept 9, 2025 using the Credit Comeback™ System. See the playbook—then book your free call. ...more

Comeback Stories (Social Proof) ,The Credit Pro Max Authority

September 25, 2025•1 min read

The Comeback Blueprint: How We’ve Rebuilt 1,000+ Credit Lives and Counting

Discover the proven Credit Comeback™ Blueprint that rebuilt 1,000+ credit lives. Fix bad credit, protect it, and leverage it with Credit Pro Max. ...more

Comeback Stories (Social Proof) ,The Credit Pro Max Authority

September 25, 2025•1 min read

Credit Is a Loaded Gun: Aim It at the Banks, Not Your Own Head

Credit is a weapon. Aim it at the banks, not yourself. Discover how to leverage your credit score for freedom with Credit Pro Max. ...more

Mindset & Motivation

September 25, 2025•1 min read

5 Savage Credit Hacks the Banks Pray You Never Learn

Learn 5 savage credit hacks banks don’t want you to know. Boost your FICO, slash interest, and fix bad credit fast with Credit Pro Max. ...more

Credit Hacks & Shortcuts

September 25, 2025•1 min read

The Credit Switch: Flip One Number and Unlock Cars, Homes, and Business Funding

Flip your credit score from denial to approval. Discover how one number unlocks homes, cars, and business funding with Credit Pro Max. ...more

Credit Leverage & Wealth

September 25, 2025•1 min read

The Silent Wealth Killer: How Bad Credit is Robbing You Blind Every Day

Stop letting bad credit rob you blind. Learn how to fix bad credit fast, rebuild your FICO, and start your Credit Comeback™ with Credit Pro Max. ...more

Credit Pain Points

September 25, 2025•1 min read

NOT READY TO GIVE US A TRY?

🔥 Tired of Getting Denied?

Every day you wait, banks are milking you dry with denials, high interest, and missed opportunities.

👉 Subscribe to the Comeback Blog and get the rawest credit hacks, insider secrets, and wealth strategies delivered straight to your inbox.

No fluff. No BS. Just the exact plays we use to rebuild, protect, and leverage credit into freedom.

Contact Us

Office: 2162 E. Williams Field Rd, Ste 111 Gilbert, AZ 85295

Legal

Privacy Policy

Terms & Conditions

Connect

© Copyright Credit Pro Max 2025

All Rights Reserved.